Valuable Investment Lessons from Benjamin Graham

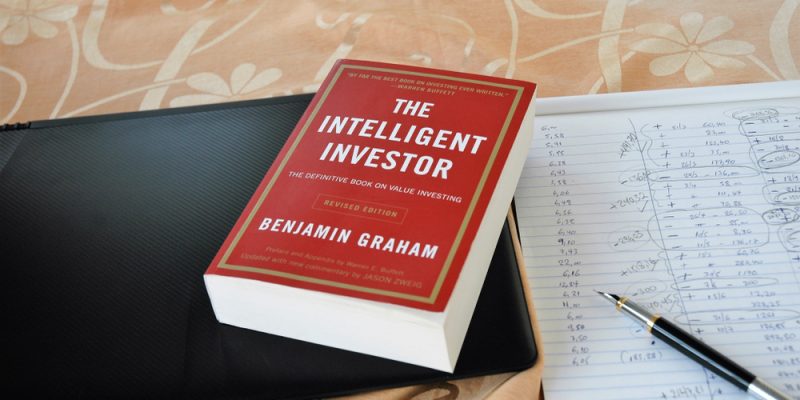

Benjamin Graham was Warren Buffet’s greatest teacher. Benjamin Graham earned the title ‘The Father of Value Investing.’ Also, something worth noting is the fact that Graham was Buffet’s professor at Columbia Business School. Graham is the author of The Intelligent Investor and Security Analysis.

One of Graham’s greatest achievements is educating the world on investing, and his investment principles have made the world’s most successful investors. Also, Graham is the reason why companies today pay their shareholders dividends. He built popular investment formulas, making him a legendary investor.

Benjamin Graham holds some of the best investment lessons that different types of investors around the world could use. Here are some of Graham’s investment lessons.

1. Expect volatility and get profits from it

One of the critical lessons of investing from Benjamin Graham is that investors should expect volatility and make profits from it. As an investor, volatility is something that you can’t just run away from. Graham illustrated the importance of embracing the risk and using it as an opportunity for making profits.

During such events of volatility, it is when the investors should be making buying and selling decisions. The stock market will always fluctuate, sometimes mildly and sometimes wildly. Graham’s lesson for the investors was to use the fluctuation to their advantage that is; choosing the right time to sell before the holdings become undervalued.

2. Ensure there is a margin of safety when investing

Graham encouraged investors to invest with a margin of safety. This refers to investing, whereby the investor only buys securities at a time when the market price is way lower than the intrinsic value of the securities. The difference between the market price and the price below the estimated intrinsic value is the margin safety. By doing so, investors are able to make investments with minimal risk.

Investing with a margin of safety was Graham’s ultimate investment strategy, which typically meant that he bought the securities at almost nothing. Graham indicated that this strategy was able to earn the investors substantial profit and, at the same time, cushion them against risk.

3. Don’t trust the market

This is one of Graham’s greatest lessons. Mr. Market was an allegory Benjamin Graham used to describe the stock market. Graham sensitized the idea that investors should not trust Mr. Market due to its contradictory behavior. The stock market is highly unpredictable and also experiences mood swings.

According to Benjamin Graham, an intelligent investor must take the time to do their homework before they trust any speculations or quotes they come across in the market.

4. Have a formula

One of Graham’s lessons to investors was the importance of having a formula. In regard to this, he emphasized the importance of using logic as opposed to emotions. With a formula, the investor will avoid emotions in investing and the stress that comes with it.

Graham himself was known to be the kind of investor that worked with formulas. Formulas such as the dollar cost averaging went a long way in helping him manage his money and, at the same time, evaluate companies he planned investing in. More so, out of the experience, Graham knew that having formulas would protect him from incurring losses in his investments that worked pretty well for him. This is one of the lessons that one of the world’s greatest investors, Warren Buffet, picked from Graham.

5. Never lose money

Avoiding losing money while investing is one of the critical lessons that Warren Buffet, among many other renowned investors, took from Graham. Graham emphasized the need to avoid losses while investing, but he also gave suggestions that would help investors with this.

Graham insisted that investors should protect themselves from losses by diversifying their portfolio. One of the most common ways investors lose money is by having one asset, which kills the investment when exposed to risk. The whole idea behind diversifying is reducing exposure to one type of asset. Through this, an investor is able to balance the risk and return of their investment.

Graham’s lesson to the investor was also to focus on constant and safe returns instead of the crazy ones. Huge returns come with huge risks, and since the market is unpredictable, it is possible that the investor might lose his money.

Graham’s advice to investors on intelligent investing is to assess a company’s management principles and its evolution before taking the big step of investing in it. While no investor can predict the next high return instrument, they can always protect themselves from financial loss.

Graham’s primary investment strategy involved doing research on the stock market and analysing stock data to identify undervalued securities. His focus was on long-term investment in companies that he systematically picked out through fundamental analysis. Successful investors like Warren Buffet and Walter Schloss owe their success to Graham’s formula.