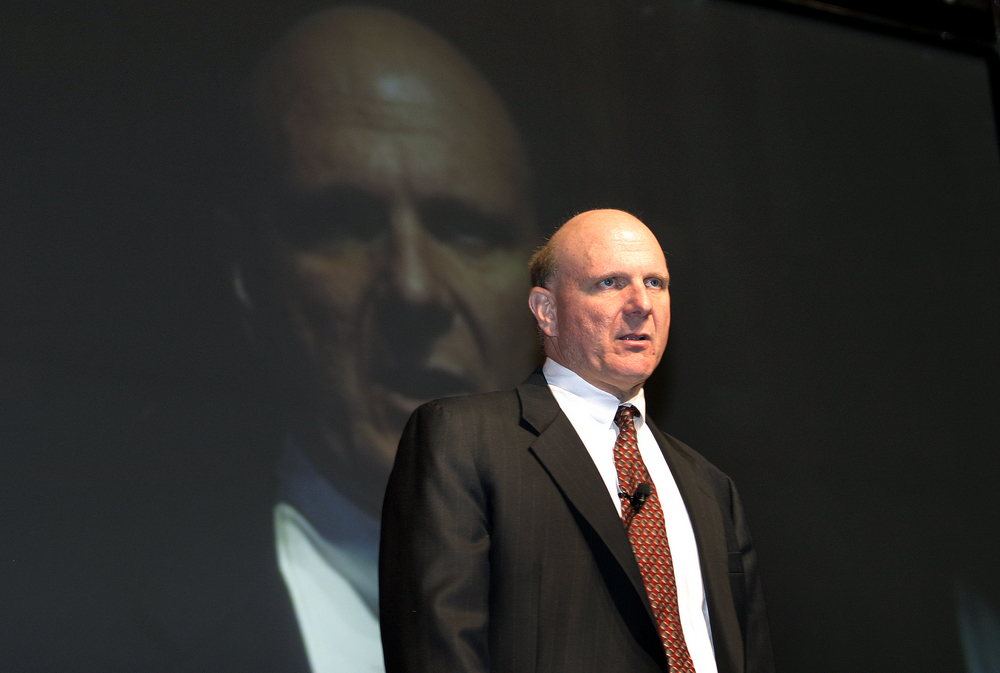

Warren Buffet “The Oracle of Omaha”

Warren Buffet or the “The Oracle of Omaha” as he is so fondly referred to by the media celebrated his 90th birthday in August 2020. For more than 60 years, this self-made billionaire has been actively involved in the running of Berkshire Hathaway, an umbrella group that operates 60 different business entities. If you have heard of Dairy Queen restaurant, Geico insurance or Duracell, then you already know what Warren Buffet is about.

How simple is the life of Warren Buffet?

Those who have interacted with Buffet closely, describe him as frugal – how else would you describe his almost religious practice of spending about $3.17 for a McDonald’s breakfast every single day? Besides that, his residence has been the same since 1958. Well, it is no wonder that he has managed to rake in a fortune from the investments he has made so far in life.

For the Oracle of Omaha, his legacy of wealth started long before he began making real money. Actually, considering that his father was a US congressman who owned a stock brokerage fund, Warren might just have been the child who inherited this business acumen. Most people would not have a clue about making money at 11 years but this was the age when Warren made his first move as an investor – he bought 6 shares each valued at $38.

With an investing career that spans more than seven decades, Warren Buffet has a cult-like following of people who just want to be a fraction of what he is. These aspiring financial savants are the reason why Warren has been the subject of so many business and investment studies. His estimated net worth is $80.3 billion. He has a long history behind him and that is what we all want to know. Where did it all start? What philosophies does he live by? Is it possible for the rest of us to be as wealthy as this one man?

How was his childhood?

He once sold recycled bottles of Coca-Cola, chewing gum, and even hawked magazines. At high school level, he had graduated his ventures to include selling stamps, golf game balls, and detailing vehicles. In 1944, when he was barely 15 years old, Warren filed his maiden return for income tax. He used the $35 he received as a deduction to buy a bicycle and watch that would help him to improve the efficiency of his newspaper delivery business. A year later would see him and a friend grow a pinball machine business which they sold for $1,200.

Before he was through with senior high, his passion for business was evident even to those who schooled with him. So much so that a caption below his yearbook picture reads, “likes math; a future stockbroker”. His passion at in business pushed him to want to skip college but his father would have none of it. It is while in college that he met and started working with Benjamin Graham, a business partner to date.

Warren Buffet’s journey to wealth

At seven years age, Warren borrowed a book titled, ‘One Thousand Ways to Make $1000’ and that is what got him interested in the idea of making money. He once said that he would make it to be a millionaire by age 30 “and if not, I am going to jump off the tallest building in Omaha.” At age 35, this value would leap to $26 million owing to partnerships he had. Although he made it to the millionaires club before 30, Warren did not become a billionaire until after he had hit 50. This happened in 1986, at a time when he was earning a salary of $50,000 from Berkshire Hathaway. Today he is one of the richest men on earth.

The most remarkable period for his wealth growth pattern was between 66 and 72 years of age. These 6 years saw his net worth literally doubling – the reports at the time record his net worth to be $35.7 billion.

What would you do with all this money? That was a no brainer for Warren judging from his 2006 action of releasing pledge letters as statements of his wealth. He pledged to donate 85% of his total wealth to 5 foundations, top among them being the Bill and Melinda gates foundation.

For someone who wishes to borrow direction from the wealth creation journey of Warren Buffet, it is important to note that not every investment he took was a success. The common denominator in all his endeavors is sticking to a value system and having a well-thought-out plan. By seeking new investment opportunities and being consistent, Warren has used Berkshire Hathaway as a stepping stone to greater heights.

From the man himself;

“What’s needed is a sound intellectual framework for making decisions and the ability to keep emotions from corroding that framework.”