Best Contactless Payments Applications You Will Love

Apart from all the negative impacts brought about by the coronavirus pandemic, it has also brought with it, room for invention; as they say, necessity is the mother of invention. Both small and large businesses have had their share of adjustments, the most evident one being turning to contactless payment. This way of transfers initially existed but was not appreciated as much as it is after the pandemic. Even with it being an easy way of payment, it has also helped to curb the rate of transfer of the novel coronavirus.

Here we are going to go through some of the best contactless payment apps that are safe for use and efficient.

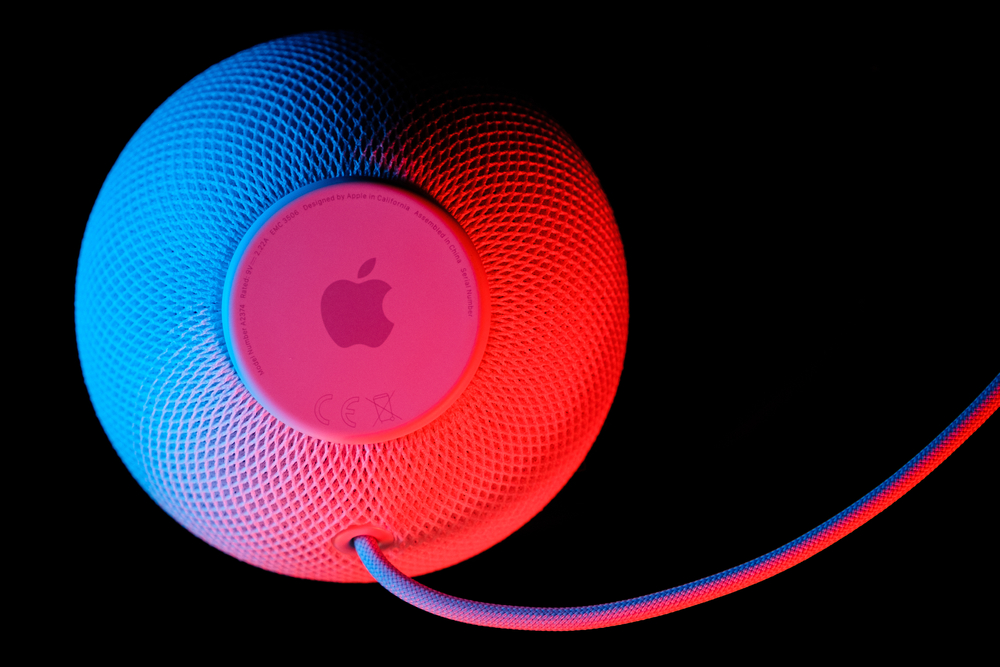

Apple Pay

Launched in mid-2014, Apple pay was presented as one of the safe and secure ways to make payments using iPhone gadgets. It works with most payment providers, therefore making deposits and withdrawals from their e-wallet easy. It works using the NFC technology, which puts it in a better position to even do online purchases.

- How does apple pay work? Entrepreneurs who want to use Apple Pay for contactless payment, have to connect with their service provider and have a point-of-sale (POS) terminal. If the business already has NFC capability, then you can easily set up your Apple Pay.

- Pricing and transaction fees: Businesses using Apple Pay contactless payment are not charged any additional fees. Similar credit rates apply across all their payment methods. The main advantage of this payment method is that there is no use of any special equipment apart from a capable contactless POS terminal.

- Audience: As 15% of smartphone users own Apple devices, 51% of businesses accept the use of Apple Pay for both their retail and wholesale transactions.

- Pros and cons: Apple Pay is accepted by many businesses and is also a safe and efficient way of making payments. However, for you to be able to use it, you have to have an Apple device. This forces many merchants to opt for other payment methods.

Google Pay

This payment method was first launched in 2018, it is a payment method for users with Android devices. The app is available online for Android device users; for merchants, it works like a credit card transaction.

- How it is set up: It requires POS contactless enabled terminals; NFC reader must be turned on for it to work. POS service providers must also be contacted for them to process payment data. It is also secure as it can only work within a short distance to the device making it hard to steal information.

- Pricing and audience: No additional fees are charged on merchants for accepting Google Pay, they don’t as well require special equipment apart from a POS terminal. Its users are still few compared to those using Apple Pay.

- Pros and cons: Google Pay is in collaboration with many major banks therefore making it easy for customers to transact. However, it has low adoption rates, this makes it hard for customers to set it up.

PayPal

PayPal works by the use of a QR reader where a customer scans it using the phone camera and input the amount being paid through the app.

- Setting up PayPal: For the app to be used, both the customer and the merchant must download it and accept contactless payment. A QR code is provided and when scanned will be able to complete the transaction.

- Security, pricing, and audience: with its tight data encryption, it is very hard to commit fraud on PayPal, additional fees do not apply at the moment but are set to start being applied in 2021. It is one of the most widely used methods of payment with over 345 million active accounts worldwide.

- Pros and cons: PayPal provides a user-friendly way of contactless money transfer thus making it easy to use. However, for one to use it, you must be connected to the internet.

Venmo

Venmo is a company owned by PayPal, it has recently introduced tools that enable contactless payment. It uses a business-specific QR code.

- Setting up: Merchants who need to use it must be licensed business owners, after that they can download the QR code for free and start using it.

- Security, pricing, and audience: Venmo is highly encrypted to keep information secure and block unauthorized users. There are no fees that are paid currently but will start applying in the future. It currently has over 59 million users considering it is new in the market.

- Pros and cons: it provides good and flawless services that give customers smooth money transfers. Venmo is however not available for sole proprietors currently.

Choosing a good contactless payment method will greatly depend on the kind of business that you run and customers’ preferences.